The city of Chicago expects that the assessment of properties in a proposed North Side special taxing district will reach $2.5 billion, according to a newly released report.

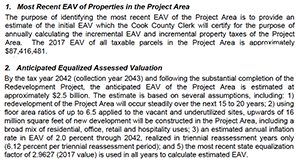

Excerpt from the city's Cortland/Chicago River TIF district

plan, showing anticipated EAV. Source: city of Chicago.

A recently released city document estimates that the equalized assessed valuation (EAV) of the area within the proposed Cortland/Chicago River tax-increment financing (TIF) district will total $2.5 billion.

The city has pitched the 168-acre TIF district to pay for streets, bridges, water pipes, sewers, transit, and other public infrastructure in the privately developed Lincoln Yards complex along the Chicago River's North Branch.

At a public meeting held on Nov. 14, 2018, officials from the Chicago Dept. of Planning and Development said that the TIF district could stockpile enough property taxes to fund $800 million of infrastructure.

The amount of property taxes the TIF district could stockpile is based on the EAV of all the properties in the district over its 23-year life. Rationale for the $2.5 billion figure comes from a "redevelopment project area and plan" document authored by consulting firm Johnson Research Group that the city recently released.

Johnson Research Group based its estimate on:

- Real-estate development within the TIF district continuing over 15 to 20 years.

- At least 16 million square feet of new development.

- State equalization factor of 2.9627 (which is multiplied by properties' assessed value to determine EAV).

- Annual inflation of two percent in EAV through 2042.

According to a spokesman for the city's planning department, next steps for the Cortland/Chicago River TIF district involve meetings in 2019: the intergovernmental Joint Review Board meets on Jan. 11, and the city's Community Development Commission holds a public hearing on Feb. 19.